Via L2: A Bitcoin Layer 2 Modular Sovereign Validity zkEVM Rollup

Via L2 is the culmination of everything we learned from 2014 over the past decade, incorporating ideas from multiple designs, Layer 1s, rollups, and early Bitcoin networks, such as Mastercoin, Counterparty, and Clearinghouse.

Over the years, we've seen the rise of competing alt Layer 1 chains. Each new chain has launched with the promise of fixing the limitations of its predecessors or competitors. May it be faster throughput, a better user experience, or lower fees.

Yet, the innovation is questionable, and this race has resulted in the proliferation of redundant infrastructure, with chains offering incremental improvements to a fragmented user base and liquidity, as ecosystems compete. For protocols built on these chains, transactions in each L1's native token often created isolated liquidity silos and higher integration complexity.

We recognize Bitcoin has already succeeded. Every L1 has to justify its existence, given that Bitcoin has already solved the problems of digital scarcity, value transfer, and decentralization.

Why should users trust other Layer 1s when Bitcoin has already delivered the most secure consensus mechanism, the fairest issuance schedule with a fixed supply, and an immutable monetary policy?

Besides programmability?

We're not trying to launch "the next big L1" because we don't believe there needs to be another one. Bitcoin already exists. It is the most secure, decentralized, and resilient chain. Rather than compete, we build on it.

Introducing Via

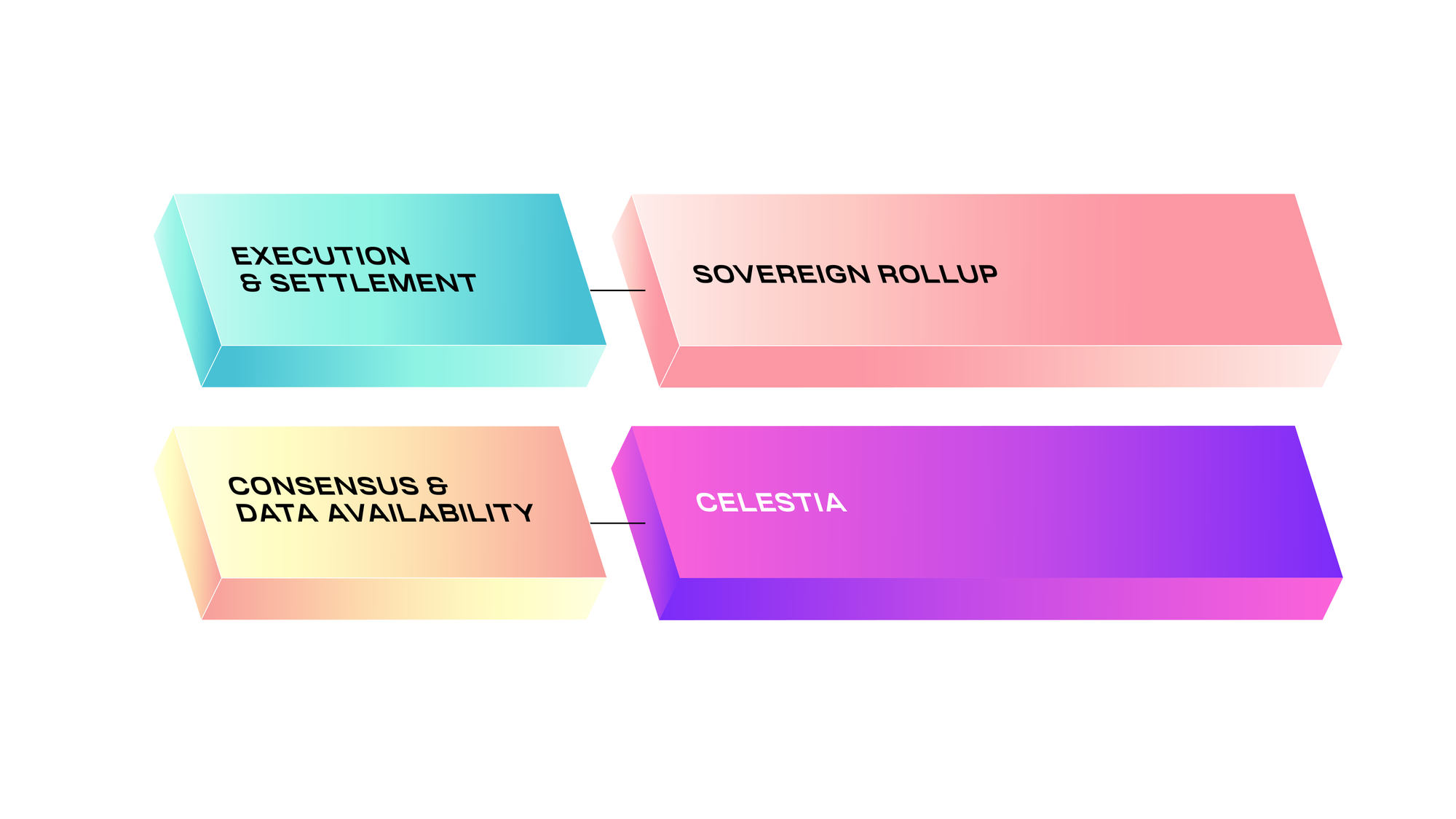

Via is a Bitcoin Layer 2 Modular Sovereign ZK-Rollup that combines zero-knowledge proofs, zkEVM, Bitcoin's PoW security, and Celestia data availability layer by adopting a modular approach without compromises.

Via processes thousands of transactions off-chain using a high-performance zkEVM environment, enabling full EVM compatibility and smart contract programmability.

Our zkEVM enables developers to write, test, deploy, or migrate existing smart contracts, using a framework and developer tools they're already familiar with, by using our SDK

Celestia acts as our data availability layer, stores each batch's calldata and zk-proofs with scalable throughput and verifiability.

Our Verifier Network ingests the data, validates every proof, and finalizes batches before periodically anchoring a compact state root to the Bitcoin blockchain.

By anchoring our rollup's state root into Bitcoin, Via inherits Bitcoin's finality guarantees and Proof-of-Work security without bloating Bitcoin's UTXO set or incurring massive fees every batch.

Via operates as a modular sovereign rollup, meaning it retains full autonomy over off-chain execution and on-chain validation.

Unlike monolithic blockchains, where the rollup is integrated into the base layer, sovereign rollups decouple execution from consensus and settlement.

This modular design allows us to innovate and evolve independently. Because execution data, data availability, and settlement are separated, each layer can evolve at its own pace.

We can upgrade to faster provers without waiting for a Bitcoin soft-fork, Celestia can lift its block size ceiling without touching Via's zkEVM, and Bitcoin can continue prioritizing immutability and security over throughput.

Even if Celestia paused, Via could queue blocks and re-publish when the DA layer resumes. If the Verifier Network stalls, funds remain safe until the proofs are confirmed. Even if Bitcoin halts (which is unlikely), the rollup can still process blocks off-chain.

Unlike traditional rollups, where users may be forced to exit a compromised chain, sovereign rollups, such as Via, allow the network to reject invalid state transitions altogether.

In the event of a faulty execution due to malicious behavior, honest nodes can coordinate a fork, preserving network integrity without relying on a fallback Layer 1 withdrawal mechanism. This gives our sovereign rollup strong autonomy, fault recovery, and resistance.

Via is designed to support smart contracts, staking, swapping, lending, farming, and more, all without compromising Bitcoin’s core principles.

Inspired by the embedded consensus ideas behind Counterparty and ClearingHouse, and enabled by new primitives such as Taproot, inscriptions, and multi-sig scripting, Via brings programmability to Bitcoin with its zkEVM environment.

Bitcoin as the secure settlement layer, Celestia handles data availability, and Via executes transactions through a high-performance zkEVM environment, enabling EVM-compatible smart contracts on Bitcoin. This architecture allows developers to deploy Ethereum/EVM dApps.

Why are gas fees paid in BTC?

Users can pay gas fees in Bitcoins while using Via, reducing complexity by eliminating the requirement to own a native token to make a transaction.

In most Layer 1s and Layer 2s, users pay gas fees using a native token (e.g., ETH on Ethereum, Luna on Terra, EOS on EOSIO, or WAVES on Waves blockchain). These native tokens also often serve multiple roles in securing the network through staking, validator payments, and other functions.

It creates a risk of tight coupling between the token's market price and the network's overall health. Validators earn fewer fees in real terms, as the price of the native token drops due to a bear market, bad sentiment, or dilution.

This weakens incentives, potentially leading to validator drop-off, reduced security guarantees, and greater vulnerability to economic or game-theoretic attacks such as bribery, collusion, or selfish behavior.

Validators may validate multiple forks of the chain simultaneously because there's little cost to doing so, which undermines consensus while increasing the chance of chain reorgs. Take, for example, Peercoin, NXT, and other early POS chains.

When validators' rewards are no longer attractive due to price collapse, attackers could bribe validators for less than the cost of a 51% attack. This attack also isn't just theoretical. Lisk saw validators (delegates) offering bribes in the form of voting rewards to maintain their position. Rather than being selected on merit or performance, validator slots were often won through pay-for-vote schemes.

Steem experienced a hostile governance takeover when a major token holder (Justin Sun) used tokens held on centralized exchanges to reassign validator votes, covering community governance. EOS block producers were caught in vote-buying, where top validators voted for one another or traded support to remain in control.

Via avoids these game-theoretic risks and unknown variables by using Bitcoin for gas fees. A non-inflationary, widely adopted, and resilient asset for fees. Separating security incentives from token price reliance.

Bitcoin-Denominated Protocol Revenue

Even though users pay transaction fees in BTC, that doesn't mean the protocol's value proposition is nonexistent. A common misunderstanding we have heard.

Via still captures fees, like any other protocol revenue, but by design, they are denominated in Bitcoin instead of the VIA token. This is not a technical limitation with tradeoffs but an intentional choice. Gas fees are still being paid, but paid in Bitcoin.

By earning protocol fees in BTC, we accumulate a hard, appreciating asset with the optionality to strategize and time buybacks of our VIA token.

We believe earning fees in your own native token is often a flawed model. Not just from the tokenomics perspective or the validator incentives standpoint. Also, from a risk management and financial planning standpoint. Protocols that accumulate their own volatile token are essentially exposed to a single, illiquid asset that they themselves control. Leading to the same recurring dilemma:

- If they hold, they risk holding an asset that may fall in value

- If they sell, they create constant selling pressure, undermining long-term token value

- Either way, it introduces fragility

Take the Ethereum Foundation, for example. They've historically sold large portions of ETH to fund operations, research, and ecosystem grants.

Yet, they also send the message:

"Holding your own token isn't necessarily the best reserve asset."

Most chains that set gas fees in their native token are stuck in a self-defeating trap. Users must buy the token to pay for gas. There's inbound demand. Yet, the protocol or its foundation, validators, ecosystem funds, etc, is often forced to sell that same token to fund operations, pay contributors, or build runway.

In effect, they have "lock-in" the price by constantly selling their own token. Directly offsetting the user buying pressure that they worked hard to create. It turns into a zero-sum game, where the protocol's success can actively suppress its token price.

Yet, the protocol or its foundation, validators, ecosystem funds, etc, is often forced to sell that same token to fund operations, pay contributors, or build runway.

Now you may wonder why a native token is chosen, considering all these downsides, dilemmas, and self-defeating mechanics.

Many teams, especially those coming from traditional finance or corporate backgrounds, build based on templates rather than first principles. Ethereum did it. Solana did it. So they just assume it's the "correct" structure. They study what exists and not why it exists, and miss the fact that Ethereum's model evolved under very different historical and economic constraints.

They chose token optics over sustainability. By using their native token for gas, it gives an immediate narrative boost.

“Look, demand for our token is growing!”

“Gas is being paid in OUR coin!”

“We’re burning our token so it’s deflationary!” (still net inflationary)

These are great marketing bullets, even if they create long-term structural issues. Investors like simple stories. Foundations like token buybacks. Token models get funded, regardless of whether they're sustainable.

Most teams copy-paste the native gas token model because

It’s easy to explain

It looks good on paper

It fits investor expectations

They don’t (or can’t) consider alternatives

Founders and VCs usually hold a lot of the native token. If the token itself becomes the center of attention used for gas, staking or farming, it potentially drives more short-term volume and higher diluted valuations. Even if they have to sell the token to fund operations, it's often seen as acceptable because the price spike already benefited insiders.

Until very recently, there weren't many credible options to denominate gas fees in hard assets like BTC. Ethereum isn't built for that. Solana doesn't support that.

Most blockchains are not modular or flexible enough to decouple execution from fee logic.

Via, with its modular architecture and Bitcoin as a settlement layer, can charge BTC for gas fees and accumulate a meaningful reserve. Most L1s and other rollups can't.

Most chains are addicted to propping up their token price through forced gas fees as a utility. Most protocols are forced sellers of their own token, which kills long-term sustainability. Most VCs and investors buy into narratives, not models. They chase "deflationary tokenomics" without asking who's buying when the protocol is constantly selling.

While users are buying gas, the protocol is selling to fund operations, runway, or buy infrastructure. So, net-net, there's often no real reduction in circulating supply, and worse still, the price can still be crushed because protocol selling pressure is constant and predictable.

Fewer users = fewer burns = less deflation

Token price drops = more selling to fund ops = downwards spiral

We refuse to play short-sighted casino games or fall into self-defeating traps. Instead, Via earns gas fees in Bitcoin to support longevity and strengthen our treasury.

Gas fees still exist, but they're paid in BTC. This choice gives us a strategic advantage. Bitcoin is a hard, globally liquid asset. If the protocol needs to fund operations or pay contributors, it can do so by selling BTC into deep, liquid markets without selling our own token, which would harm investors.

By earning BTC, we have more optionality to strategize and time to buy back VIA, such as buying during market downturns when our token is undervalued. This allows us to buy back more supply for the same amount of capital, potentially burning excess tokens and strengthening long-term value.

It's even better than earning fees in stablecoins. While dollars lose value over time due to inflation, Bitcoin is a hard, appreciating asset.

In structural bear markets, BTC maintains deep liquidity and strong store-of-value properties. In bull markets, it disproportionately amplifies the protocol's treasury value. Turning protocol value into long-term strategic leverage.

Protocols that earn in what they print are inherently fragile. They depend on a constant inflow and perpetual demand for their own token, just to stay afloat. When the market turns, they're forced to sell into their own community, undermining investors.

We won't need to sell our own token into a thin/less liquid market to survive during market downturns. While other protocols are forced to dump their native token to cover costs and hurt their own investors, we can buy more of the VIA supply during market downturns to potentially burn.

New users come to Via because they want to use a Bitcoin Layer 2. They shouldn't be forced to pay in anything other than Bitcoin.

Via L2 Ecosystem Potential

While gas fees on Via are paid in Bitcoin for simplicity and resiliency, we are not only building the L2 but also an entire ecosystem.

In most Layer 1 and Layer 2 ecosystems, value is fragmented, making it difficult for any single stakeholder to derive meaningful benefits.

Take Ethereum, for example. While it earns fees through gas and staking, the most lucrative dApps, such as Uniswap, Aave, and Compound, are independent, each with its own token and monetization models.

A user, for example, may generate $10k worth of fees per year while, for example, only paying $100 in Ethereum gas fees, $200 in Uniswap trading fees, $150 in Aave, and $100 in Compound rewards. Resulting in the economic value scattered across multiple tokens and siloed protocols, an Ethereum holder doesn't directly benefit.

Instead of waiting for third parties to build dApps, Via builds its own DEX swap, similar to Uniswap, lending protocol, and yield opportunities.

These dApps will generate real protocol revenue, which flows back to investors through either buybacks or revenue sharing.

Therefore, when a user engages with activity on the Via ecosystem dApps, they still incur a minimal Bitcoin gas fee to settle on the base layer.

Still, all application-layer value flows back to the Via ecosystem and its token holders. While anyone is free to build dApps on Via, protocols built by the team capture the full value of user activity.

Similarly, Apple doesn't just make phones. They own iCloud services, Apple Music, Apple TV+, and more, bringing a premium experience to users. Revenue for Apple across multiple business lines creates a higher lifetime value than if separate companies provided these services.

While a strong narrative has favored infrastructure over consumer dApps in the last two cycles, this narrative has been growing stronger and is likely to continue doing so.

For Via, rather than 'merely' building, providing, and owning the Layer 2 infrastructure, dApps built by our team that generate revenue will flow back to the ecosystem and token holders.

Rather than relying on speculative gas fee revenue, Via token holders benefit from multiple revenue streams, thereby diversifying their income.

A typical DeFi power user might spend $2000 on fees for trading, lending, and yield activities. In a fragmented ecosystem, this value might be split between 5-20 different protocols and tokens. DApps built by the team capture the entire value, creating a higher per-user value accrual for the token.

App Revenue Generation and Protocol Revenue

Uniswap launched its own Layer 2, and Ethena is building an L1, which are examples of L1s and L2s having massive valuations. Meanwhile, GMX, Pancakeswap, and Lido generate real revenue but struggle to attract the valuations or capital on par with Layer 1s or Layer 2 rollups.

There's a good reason for it, and that's the expectation and anticipation of the entire ecosystem's potential.

Just the anticipation alone for potential a for ecosystem brings these elusive L1 and L2 premiums combined with attracting capital. Via brings in both as we not only deliver the L2 infrastructure and build our own real revenue generation dApps.

As more users join, TVL grows. Increased on-chain activity drives protocol revenue from sources like DEX swaps, lending interest, and liquidations. This revenue can then be used for buybacks or revenue sharing, increasing demand for the VIA token.

Incentive programs further attract users and capital, which in turn feed back into liquidity, activity, and growth, creating a self-reinforcing cycle.

More users → more TVL → more revenue → more token demand → more users.

These elusive L2 premiums exist due to ecosystem potential. Enabling dApps instead of competing with them. Take Base, ZKSync, Starknet, and Optimism as examples.

Regarding the tech of Via zkrollup, it deserves several separate articles due to Via's large scope, as evident by its codebase alone.

Via represents a safer, more sustainable business model compared to typical crypto tokens, due to its diversified income from its ecosystem, rather than a single dApp. All ecosystem success flows to investors/holders. Ecosystem potential has always been consistently valued higher than single-app utility.

If decentralized applications consistently generate more fees than the L1 or L2 they run on, it shows that value mainly accrues at the application layer. On the other hand, if the base protocol earns most of the fees, it supports the Fat Protocol Thesis, which supports the idea that value is concentrated at a shared protocol layer rather than at the application layer

Unlike typical Layer 1s and Layer 2s that only capture gas fees, Via follows a model where the Via L2 network is more than a Bitcoin Layer 2; it's about the ecosystem.

Investors benefit from the success of the entire ecosystem, not just a single app.

Once live, all major revenue streams, including DEX fees, lending, bridge fees, and yield farming, will flow back to the Via token and ecosystem.

Value accrues at multiple levels in a Layer 2 stack, and Via captures value at both the sequencer level and the application layer.

Why build a Layer 2 on Bitcoin? Why not Ethereum?

Bitcoin wasn't just the first successful implementation of real decentralized money. It was the start of a new monetary paradigm.

Over the past decade, we have seen numerous projects/chains pitching themselves as a superior version of Bitcoin. All of these are now either dead, failing to gain traction, or underperforming in terms of price against Bitcoin.

Bitcoin's immutability and credibility come from the fact that its origin was transparent, fair, and uncorrupted. No premine, venture capital, or foundation.

You cannot replicate the Big Bang.

Every subsequent project exists within the gravitational field it created. Either react to it, attempt to extend its reach, or build on top of it.

With uninterrupted 0-downtime operation and a market capitalization exceeding $1 trillion, Bitcoin's security is unmatched, its brand is globally iconic, and its role as digital gold is more entrenched than ever.

Yet there's a paradox. The purity of Bitcoin also locks it into a narrow design. The world's most superior asset and most secure decentralized network is underutilized.

Bitcoin wasn't built for complex applications or high-volume transactions. This 'programmability' is constrained by the limited throughput & weak smart contract capabilities, which are often viewed by many as a shortcoming or dealbreaker. Some even believe that it could threaten Bitcoin's relevance.

While many often point to Bitcoin's technical limitations, stability constraints, lack of programmability, and slow development cycles. The world's most secure and valuable blockchain processes fewer transactions per second than its more experimental alternative, Ethereum.

The lack of programmability isn't just another shortcoming for many, but often a deal-breaker, as it threatens Bitcoin's chance to evolve from digital gold to the base layer of global, decentralized finance.

Yet, Bitcoin's fair and transparent creation cannot be recreated, just like the unrepeatable event of the Big Bang. Every subsequent project exists within the gravitational field it created. Either build around it, react to it, or attempt to extend its reach.

Every altcoin must justify its existence, given that Bitcoin has already solved digital scarcity, value transfer, and decentralization. Every Layer 1 chain must explain why users should trust new mechanisms when Bitcoin's proof-of-work has never been successfully attacked.

Every blockchain must compete for the same developers, users, and capital that Bitcoin first attracted. Even Ethereum, for all its innovation, is constantly measured against Bitcoin's security, monetary policy, and decentralization.

Everything revolves around the concepts that Bitcoin established: decentralization, immutability, trustlessness, and sound money.

Projects either complement Bitcoin, such as the Lightning Network, or compete against it, like Ethereum, or attempt to extend its reach or capabilities, as seen in sidechains like Tether Plasma or Layer 2 solutions such as Via, BitVM, or Babylon.

Modern financial applications demand throughput in the hundreds with sub-second finality. This performance gap has forced many into a false dichotomy between Bitcoin's security and Ethereum's expressive programmability.

As many Bitcoin holders seek DeFi functionality, they are often forced to use WBTC on Ethereum Layer 2s.

A fundamental compromise that forces users to trust Ethereum's security model, monetary policy, and governance structure rather than Bitcoin's proof-of-work security model, fixed supply, and monetary policy.

Bitcoin’s proof-of-work security model is grounded in objective physical reality. Bitcoin is secured by real energy expenditure and computational difficulty, rather than subjective or socially enforced (governance votes, trusted intermediaries, or validator coordination)

So, in contrast to other Layer 1 chains, where finality can be reversed, delayed, or debated, often at the whim of validators, boards, or bribed insiders.

Bitcoin’s finality is thermodynamically enforced by the laws of physics, not by human agreement.

Ethereum fundamentally changed its token economics by abandoning its fixed supply with a dynamic supply system marketed as "ultra around money".

This system relies on on-chain activity to burn ETH. Ethereum now uses a Proof-of-Stake model to secure its network. In this system, validators stake ETH to earn rewards from both new issuance and transaction fees.

In an extreme scenario, if Ethereum Layer 2s continue to siphon too much transaction volume, weakening ETH's deflationary pressure, which erodes staking yields and validator incentives, creating a risk of triggering a downward spiral of exits.

On the other hand, Bitcoin has a fixed issuance schedule. Bitcoin's Proof-of-Work secures the network through the energy and hardware costs of miners, thereby insulating its security from tokenomic feedback loops.

Bitcoin is a better choice as a baselayer for Via due to its fewer unpredictable variables, lower risks, and questionable future compared to Ethereum or other layer 1s.

By anchoring our rollup's state root into Bitcoin, Via inherits Bitcoin's finality guarantees and Proof-of-Work security without bloating Bitcoin's UTXO set or incurring massive fees every batch.

Users who chose Bitcoin for its security, immutability, and monetary properties shouldn't be forced to accept Ethereum's or any other L1's different trade-offs to access modern financial functionality or programmability.

Perhaps the world doesn’t need another layer 1 pretending to be decentralized. Instead, focus on building on top of Bitcoin. Bitcoin doesn't need to be replaced.

That's where a Layer 2 comes in. Not just any Layer 2, but one that brings familiar tooling and developer-friendly infrastructure to Bitcoin, allowing builders to deploy their apps.

Via is powered and partnered by zkSync and Celestia. Combining zkSync’s battle-tested stack with Celestia’s modular data availability to bring scalable smart contracts to Bitcoin.

Regarding the tech of Via modular sovereign zk-rollup, it deserves several separate articles, which will be released.

Interest? Reach out to us through our official channels

Try out our Alpha Testnet by using Metmask to add as a custom network: https://docs.onvia.org/developer-docs/connect-to-via-network

Network Name: VIA Alpha Testnet

Chain ID: 25223

RPC URL: https://via.testnet.viablockchain.dev

Base Token: BTC

Decimals: 18

Block Explorer: https://testnet.blockscout.onvia.org

Try out our Alpha Testnet Bridge with the Xverse BTC wallet by getting free testnet BTC to bridge: https://docs.onvia.org/user-guide/bridge-btc-between-bitcoin-and-via

🔗 Github: https://github.com/vianetwork

👥 Discord: https://discord.gg/ReS5cz8M6H

📚 Documentation: https://docs.onvia.org

⚙️ Via Core: https://github.com/vianetwork/via-core

🛠️ Via SDK: https://npmjs.com/package/@vianetwork/via-ethers

🌐 Website: https://buildonvia.org

𝕏 Twitter: https://x.com/buildonvia

🧭 Explorer: https://testnet.blockscout.onvia.org/

- Current phase of the project: Phase 3 Alpha testnet

- Phase 4: Beta Testnet

- Phase 5 pre-launch

- Phase 6 Mainnet v1

- Phase 7 mainnet v2