Why are gas fees paid in BTC?

Via is a Bitcoin Layer 2 Modular Sovereign ZK-Rollup that combines zero-knowledge proofs, zkEVM, Bitcoin's PoW security, and Celestia data availability layer by adopting a modular approach without compromises. Users can pay gas fees in Bitcoin while using Via.

Quick introduction

Via processes thousands of transactions off-chain using a high-performance zkEVM environment, enabling full EVM compatibility and smart contract programmability.

Our zkEVM enables developers to write, test, deploy, or migrate existing smart contracts, using a framework and developer tools they're already familiar with, by using our SDK

Celestia acts as our data availability layer, stores each batch's calldata and zk-proofs with scalable throughput and verifiability.

Our Verifier Network ingests the data, validates every proof, and finalizes batches before periodically anchoring a compact state root to the Bitcoin blockchain.

By anchoring our rollup's state root into Bitcoin, Via inherits Bitcoin's finality guarantees and Proof-of-Work security without bloating Bitcoin's UTXO set or incurring massive fees every batch.

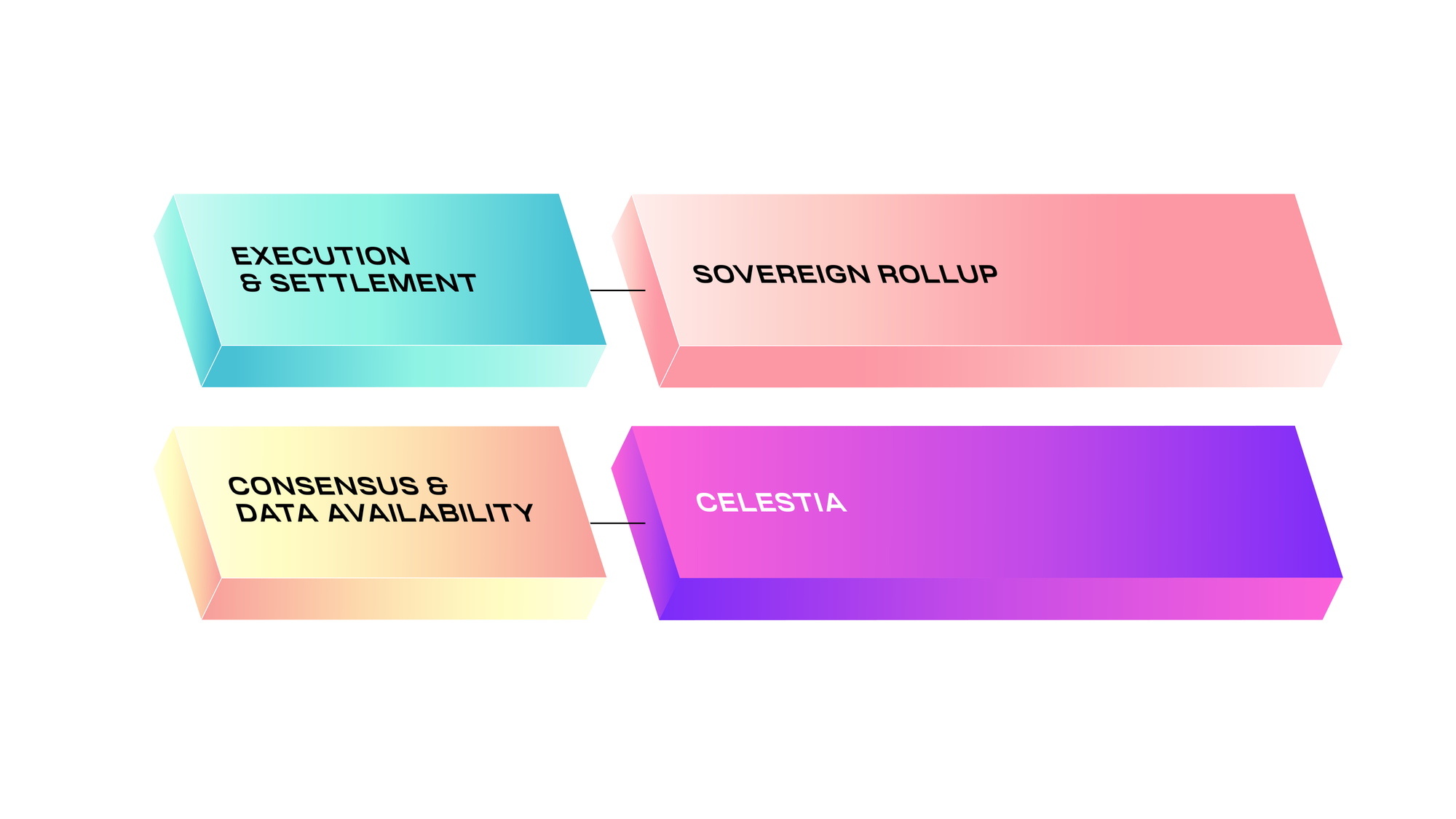

Via operates as a modular sovereign rollup, meaning it retains full autonomy over off-chain execution and on-chain validation.

Unlike monolithic blockchains, where the rollup is integrated into the base layer, sovereign rollups decouple execution from consensus and settlement.

This modular design allows us to innovate and evolve independently. Because execution data, data availability, and settlement are separated, each layer can evolve at its own pace.

Looking for a full introduction about Via, our Bitcoin L2 sovereign zk-rollup? Read it here: https://blog.onvia.org/introducing-via-a-bitcoin-l2-sovereign-zk-rollup

Incentives and game-theoretic risks

In most Layer 1s and Layer 2s, users pay gas fees using a native token (e.g., ETH on Ethereum, Luna on Terra, EOS on EOSIO, or WAVES on Waves blockchain). These native tokens also often serve multiple roles in securing the network through staking, validator payments, and other functions.

It creates a risk of tight coupling between the token's market price and the network's overall health. Validators earn fewer fees in real terms, as the price of the native token drops due to a bear market, bad sentiment, or dilution.

This weakens incentives, potentially leading to validator drop-off, reduced security guarantees, and greater vulnerability to economic or game-theoretic attacks such as bribery, collusion, or selfish behavior.

Validators may validate multiple forks of the chain simultaneously because there's little cost to doing so, which undermines consensus while increasing the chance of chain reorgs. Take, for example, Peercoin, NXT, and other early POS chains.

When validators' rewards are no longer attractive due to price collapse, attackers could bribe validators for less than the cost of a 51% attack. This attack also isn't just theoretical. Lisk saw validators (delegates) offering bribes in the form of voting rewards to maintain their position. Rather than being selected on merit or performance, validator slots were often won through pay-for-vote schemes.

Steem experienced a hostile governance takeover when a major token holder (Justin Sun) used tokens held on centralized exchanges to reassign validator votes, covering community governance. EOS block producers were caught in vote-buying, where top validators voted for one another or traded support to remain in control.

Via avoids these game-theoretic risks and unknown variables by using Bitcoin for gas fees. A non-inflationary, widely adopted, and resilient asset for fees. Separating security incentives from token price reliance.

Bitcoin-Denominated Protocol Revenue

Even though users pay transaction fees in BTC, that doesn't mean the protocol's value proposition is nonexistent. A common misunderstanding we have heard.

Via still captures fees, like any other protocol revenue, but by design, they are denominated in Bitcoin instead of the VIA token. This is not a technical limitation with tradeoffs but an intentional choice. Gas fees are still being paid, but paid in Bitcoin.

By earning protocol fees in BTC, we accumulate a hard, appreciating asset with the optionality to strategize and time buybacks of our VIA token.

We believe earning fees in your own native token is often a flawed model. Not just from the tokenomics perspective or the validator incentives standpoint. Also, from a risk management and financial planning standpoint. Protocols that accumulate their own volatile token are essentially exposed to a single, illiquid asset that they themselves control. Leading to the same recurring dilemma:

If they hold, they risk holding an asset that may fall in value

If they sell, they create constant selling pressure, undermining long-term token value

Either way, it introduces fragility

Take the Ethereum Foundation, for example. They've historically sold large portions of ETH to fund operations, research, and ecosystem grants.

Yet, they also send the message:

"Holding your own token isn't necessarily the best reserve asset."

Most chains that set gas fees in their native token are stuck in a self-defeating trap. Users must buy the token to pay for gas. There's inbound demand. Yet, the protocol or its foundation, validators, ecosystem funds, etc, is often forced to sell that same token to fund operations, pay contributors, or build runway.

In effect, they have "lock-in" the price by constantly selling their own token. Directly offsetting the user buying pressure that they worked hard to create. It turns into a zero-sum game, where the protocol's success can actively suppress its token price.

Yet, the protocol or its foundation, validators, ecosystem funds, etc, is often forced to sell that same token to fund operations, pay contributors, or build runway.

Now you may wonder why a native token is chosen, considering all these downsides, dilemmas, and self-defeating mechanics.

Many teams, especially those coming from traditional finance or corporate backgrounds, build based on templates rather than first principles. Ethereum did it. Solana did it. So they just assume it's the "correct" structure. They study what exists, not why it exists, and overlook the fact that Ethereum's model evolved under very different historical and economic constraints.

They chose token optics over sustainability. By using their native token for gas, it gives an immediate narrative boost.

“Look, demand for our token is growing!”

“Gas is being paid in OUR coin!”

“We’re burning our token so it’s deflationary!” (still net inflationary)

These are great marketing bullets, even if they create long-term structural issues. Investors like simple stories. Foundations like token buybacks. Token models get funded, regardless of whether they're sustainable.

Most teams copy-paste the native gas token model because

It’s easy to explain

It looks good on paper

It fits investor expectations

They don’t (or can’t) consider alternatives

Founders and VCs usually hold a lot of the native token. If the token itself becomes the center of attention used for gas, staking or farming, it potentially drives more short-term volume and higher diluted valuations. Even if they have to sell the token to fund operations, it's often seen as acceptable because the price spike already benefited insiders.

Until very recently, there weren't many credible options to denominate gas fees in hard assets like BTC. Ethereum isn't built for that. Solana doesn't support that.

Most blockchains are not modular or flexible enough to decouple execution from fee logic.

Via, with its modular architecture and Bitcoin as a settlement layer, can charge BTC for gas fees and accumulate a meaningful reserve. Most L1s and other rollups can't.

Most chains are addicted to propping up their token price through forced gas fees as a utility. Most protocols are forced sellers of their own token, which kills long-term sustainability. Most VCs and investors buy into narratives, not models. They chase "deflationary tokenomics" without asking who's buying when the protocol is constantly selling.

While users are buying gas, the protocol is selling to fund operations, runway, or buy infrastructure. So net-net there's often no real reduction of circulating supply, and worse, the price can still get crushed because protocol selling pressure is constant and predictable.

Fewer users = fewer burns = less deflation

Token price drops = more selling to fund ops = downwards spiral

We prefer not to play these short-sighted casino games or fall into self-defeating traps. Instead, Via earns gas fees in Bitcoin to support longevity and strengthen our treasury.

Gas fees still exist, but they're paid in BTC. This choice gives us a strategic advantage. Bitcoin is a hard, globally liquid asset. If the protocol needs to fund operations or pay contributors, it can do so by selling BTC into deep, liquid markets without selling our own token, which would harm investors.

By earning BTC, we have more optionality to strategize and time to buy back VIA, such as buying during market downturns when our token is undervalued. This allows us to buy back more supply for the same amount of capital, potentially burning excess tokens and strengthening long-term value.

It's even better than earning fees in stablecoins. While dollars lose value over time due to inflation, Bitcoin is a hard, appreciating asset.

In structural bear markets, BTC maintains deep liquidity and strong store-of-value properties. In bull markets, it disproportionately amplifies the protocol's treasury value. Turning protocol value into long-term strategic leverage.

Protocols that earn in what they print are inherently fragile. They depend on a constant inflow and perpetual demand for their own token, just to stay afloat. When the market turns, they're forced to sell into their own community, undermining investors.

We won't need to sell our own token into a thin/less liquid market to survive during market downturns. While other protocols are forced to dump their native token to cover costs and hurt their own investors, we can buy more of the VIA supply during market downturns to potentially burn.

New users come to Via because they want to use a Bitcoin Layer 2. They shouldn't be forced to pay in anything other than Bitcoin.

Making users buy and hold separate gas tokens just to use the network defeats the point. It adds friction and complexity. Gas fees are paid in Bitcoin. Bitcoin is the asset users already trust to transfer value and store value.

Interested in why we chose to build on Bitcoin? Read our article here:

Via L2 Ecosystem Potential

While gas fees on Via are paid in Bitcoin for simplicity and resiliency, we are not only building the L2 but also an entire ecosystem.

In most Layer 1 and Layer 2 ecosystems, value is fragmented, making it difficult for any single stakeholder to derive meaningful benefits.

Take Ethereum, for example. While it earns fees through gas and staking, the most lucrative dApps, such as Uniswap, Aave, and Compound, are independent, each with its own token and monetization models.

A user, for example, may generate $10k worth of fees per year while, for example, only paying $100 in Ethereum gas fees, $200 in Uniswap trading fees, $150 in Aave, and $100 in Compound rewards. Resulting in the economic value scattered across multiple tokens and siloed protocols, an Ethereum holder doesn't directly benefit.

Instead of waiting for third parties to build dApps, Via builds its own DEX swap, similar to Uniswap, lending protocol, and yield opportunities.

These dApps will generate real protocol revenue, which flows back to investors through either buybacks or revenue sharing.

Therefore, when a user engages with activity on the Via ecosystem dApps, they still incur a minimal Bitcoin gas fee to settle on the base layer.

Still, all application-layer value flows back to the Via ecosystem and its token holders. While anyone is free to build dApps on Via, protocols built by the team capture the full value of user activity.

Similarly, Apple doesn't just make phones. They own iCloud services, Apple Music, Apple TV+, and more, bringing a premium experience to users. Revenue for Apple across multiple business lines creates a higher lifetime value than if separate companies provided these services.

While a strong narrative has favored infrastructure over consumer dApps in the last two cycles, this narrative has been growing stronger and is likely to continue doing so.

For Via, rather than 'merely' building, providing, and owning the Layer 2 infrastructure, dApps built by our team that generate revenue will flow back to the ecosystem and token holders.

Rather than relying on speculative gas fee revenue, Via token holders benefit from multiple revenue streams, thereby diversifying their income.

A typical DeFi power user might spend $2000 on fees for trading, lending, and yield activities. In a fragmented ecosystem, this value might be split between 5-20 different protocols and tokens. DApps built by the team capture the entire value, creating a higher per-user value accrual for the token.

App Revenue Generation and Protocol Revenue

Uniswap launched its own Layer 2, and Ethena is building an L1, which are examples of L1s and L2s having massive valuations.

Meanwhile, GMX, Pancakeswap, and Lido generate real revenue but struggle to attract the valuations or capital on par with Layer 1s or Layer 2 rollups.

There's a good reason for it, and that's the expectation and anticipation of the entire ecosystem's potential.

Just the anticipation alone for potential a for ecosystem brings these elusive L1 and L2 premiums combined with attracting capital. Via brings in both as we not only deliver the L2 infrastructure and build our own real revenue generation dApps.

As more users join, TVL grows. Increased on-chain activity drives protocol revenue from sources like DEX swaps, lending interest, and liquidations. This revenue can then be used for buybacks or revenue sharing, increasing demand for the VIA token.

Incentive programs further attract users and capital, which in turn feed back into liquidity, activity, and growth, creating a self-reinforcing cycle.

More users → more TVL → more revenue → more token demand → more users.

These elusive L2 premiums exist due to ecosystem potential, as mentioned before. Enabling dApps instead of competing with them. Take Base, ZKSync, Starknet, and Optimism as examples.

Regarding the tech of Via zkrollup, it deserves several separate articles due to Via's large scope, as evident by its codebase alone.

Via represents a safer, more sustainable business model compared to typical crypto tokens, due to its diversified income from its ecosystem, rather than a single dApp. All ecosystem success flows to investors/holders. Ecosystem potential has always been consistently valued higher than single-app utility.

If decentralized applications consistently generate more fees than the L1 or L2 they run on, it shows that value mainly accrues at the application layer. On the other hand, if the base protocol earns most of the fees, it supports the Fat Protocol Thesis, which supports the idea that value is concentrated at a shared protocol layer rather than at the application layer

Unlike typical Layer 1s and Layer 2s that only capture gas fees, Via follows a model where the Via L2 network is more than a Bitcoin Layer 2; it's about the ecosystem.

Investors benefit from the success of the entire ecosystem, not just a single app.

Once live, all major revenue streams, including DEX fees, lending, bridge fees, and yield farming, will flow back to the Via token and ecosystem.

Value accrues at multiple levels in a Layer 2 stack, and Via captures value at both the sequencer level and the application layer.